Mercoledì, Dicembre 5th/ 2012

– di Maria Laura Barbuto, Sergio Basile –

Europa / Ancora un Nuovo Record di Disoccupati / Unione Europea / Crisi / Disoccupazione / Statistiche / Eurostat / Giovani / Società / Governi / Youth Guarantee / Laszlo Andor

The distributor charges $10 per bike for shipping for 1 to 10 bikes but $8 per bike for 11 to 20 bikes. If Bert wants to save money and control his cost of goods sold, he can order an 11th bike and drop his shipping cost by $2 per bike. It is important for Bert to know what is fixed and what is variable so that he can control his costs as much as possible.

Let’s examine Tony’s screen-printing company to illustrate how costs can remain fixed in total but change on a per-unit basis. Ifthe total direct labor cost increases as the volume of outputincreases and decreases as volume decreases, direct labor is avariable cost. Piecework pay is an excellent example of directlabor as a variable cost. In addition, direct labor is frequently avariable cost for workers paid on an hourly basis, as the volume ofoutput increases, more workers are hired. However, sometimes thenature of the work or management policy does not allow direct laborto change as volume changes and direct labor can be a fixedcost.

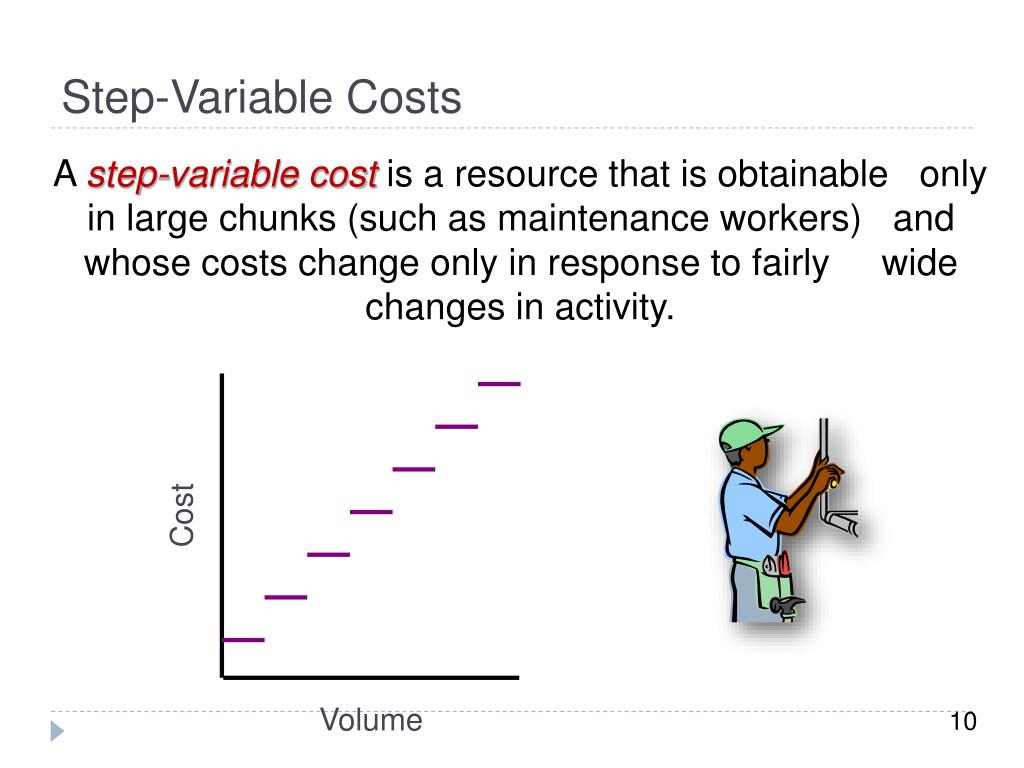

These classifications are generally used for long-range planning purposes and are covered in upper-level managerial accounting courses, so they are only briefly described here. One way to deal with a curvilinear cost patternis to assume a linear relationship between costs and volume withinsome relevant range. Within that relevant range, the total costvaries linearly with volume, at least approximately. Outside of therelevant range, we presume the assumptions about cost behavior maybe invalid. Step variable cost is also a subtype of variable cost that remains the same up to a particular level of output and increases once that particular output level is breached.

If the shop begins receiving 31 or more customers per hour, it must hire a second employee, increasing its costs to $70 ($40 for two employees, $30 for others). Additionally, a step cost analysis can aid in optimizing production schedules, resource allocation, and capacity utilization to achieve operational efficiency. The net return or profit from the pencil example can be computed by using variable and fixed costs.

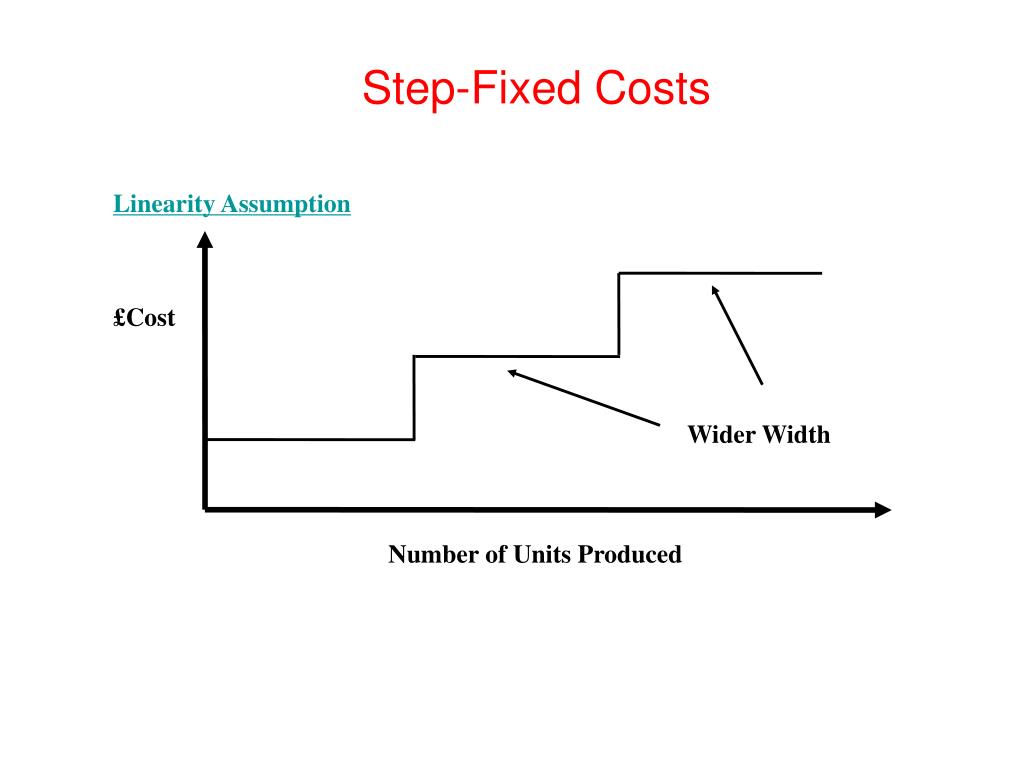

The costs will not fluctuate for a certain range of output, but will abruptly rise or fall after crossing a threshold level. When you map out step costs on a graph, they reveal a stair-step pattern. Businesses generally anticipate a certain amount of fixed or budgeted cost when activity levels remain constant over an expected range.

Ocean Breeze pays $2,000 per month, regardless of the number of rooms rented. Even if it does not rent a single room during the month, Ocean Breeze still must remit this tax to the county. However, for every night that a room is rented, Ocean Breeze must remit an additional tax amount of $5.00 per room per night.

These classifications are generally used for long-range planning purposes. A second shop floor supervisor, along with additional support personnel, would be necessary if demand for the product increased to 2,001-4,000 units per day. Therefore, the total salary costs of shop floor supervisors vary with changes in product demand. It may make sense to incur higher step costs if revenue is sufficient to cover the higher cost and provide an acceptable return. If the increase in volume is relatively minor, but still calls for incurring a step cost, profits may actually decline.

In practice, the classification of costs changes as the use of the cost data changes. In fact, a single cost, such as rent, may be classified by one company as a fixed cost, by another company as a committed cost, and by even another company as a period cost. Understanding different cost classifications and how certain costs can be used in different ways is critical to managerial accounting.

A proper management and control over costs is crucial to maintain and grow profits which is the primary objective of every commercial business. The first step in achieving this is to understand the nature of costs that a business incurs while carrying out its operations as well as the factors affecting those costs. It is not unheard of for a business to decide against taking steps to increase volume in order to maintain profitability at current levels. Let us discuss the importance of understanding the points on a step cost graph through the explanation below. When they produce 625 boats, Carolina Yachts has an AFC of $2,496 per boat.

The concept is used when making investment decisions and deciding whether to accept additional customer orders. A step cost is a fixed cost how to invest tax within certain boundaries, outside of which it will change. The same pattern applies in reverse when the volume of activity declines.